AI Solutions for Lending

Demonstrably improve loan processing quality by minimizing manual effort and reducing the time and risk of human error.

A Game-Changing Approach to Lending

Banks, Credit Unions, and other lenders face critical challenges in processing loans, especially now that volumes have decreased with interest rates rising and the uniqueness of borrower data. ELASTECH’s Lending Intelligence Platform (LIP) leverages modern AI technology to overcome these challenges by automating most or all of the lending process with unprecedented accuracy and scale. This has proven to reduce risks, cut costs, and improve the customer experience. Schedule a discovery call to explore and confirm the benefits of LIP for your organization.

High operational expenses that result from traditional loan processing.

Data discrepancies as a result of manual processing caused by human errors.

Rule-based automation lacks flexibility with any data falling out of predefined limits.

Increased time to fund new loans due to manual processes.

Incomplete data from a wide array of document formats due to scanning inaccuracy.

Inability to scale, requiring more turnaround times without adding headcount.

A Game-Changing Approach to Lending

Banks, Credit Unions, and other lenders face critical challenges in processing loans, especially now that volumes have decreased with interest rates rising and the uniqueness of borrower data. ELASTECH’s Lending Intelligence Platform (LIP) leverages modern AI technology to overcome these challenges by automating most or all of the lending process with unprecedented accuracy and scale. This has proven to reduce risks, cut costs, and improve customer experience. Schedule a discovery call to explore and confirm the benefits of LIP for your organization.

High operational expenses that result from traditional loan processing.

Data discrepancies as a result of manual processing caused by human errors.

Rule-based automation lacks flexibility with any data falling out of predefined limits.

Increased time to fund new loans due to manual processes.

Incomplete data from various document formats due to scanning inaccuracy.

Inability to scale, requiring more turnaround times without adding headcount.

Taking Advantage of critical benefits

Rapidly Process Loan Applications

LIP scans and analyzes loan documents to identify and validate critical data points. Missing information and discrepancies are immediately flagged to quickly address exceptions.

Save Costs with every QA/QC Process

LIP reduces QA/QC processes from days down to minutes. This has proven to be an immense cost saver, reserving human involvement to exception handling.

Quick & Data-driven Loan Decisions

LIP achieves an unmatched level of accuracy that manual effort cannot consistently deliver, enabling application and funding decisions that are based on clean and validated data.

Sell Loan Packages for Premium Prices

LIP fully automates loan classifications, enabling lenders to instantly classify and stack loans for buyers, which removes friction from selling unaudited or uncertified loans to investors.

Distinct Benefits over OCR Technology

OCR solely relies on character recognition, typically providing an accuracy of 65%–80%. LIP’s advanced graphic scanning understands and extracts loan data at 99.9% accuracy.

Achieve Exceptional Audit Compliance

LIP leverages modern AI features to guarantee that the entirety of your loan data is 100% valid and compliant with any regulatory requirements and investor criteria.

Rapidly Process Loan Applications

LIP scans and analyzes loan documents to identify and validate critical data points. Missing information and discrepancies are immediately flagged to quickly address exceptions. Read more

Save Costs with every QA/QC Process

LIP reduces QA/QC processes from days down to minutes. This has proven to be an immense cost saver, reserving human involvement to exception handling. Read more

Quick & Data-driven Loan Decisions

LIP achieves an unmatched level of accuracy that manual effort cannot consistently deliver, enabling application and funding decisions that are based on clean and validated data. Read more

Sell Loan Packages for Premium Prices

LIP fully automates loan classifications, enabling lenders to instantly classify and stack loans for buyers, which removes friction from selling unaudited or uncertified loans to investors. Read more

Distinct Benefits over OCR Technology

LIP achieves an unmatched level of accuracy that manual effort cannot consistently deliver, enabling application and funding decisions that are based on clean and validated data. Read more

Sell Loan Packages for Premium Prices

LIP fully automates loan classifications, enabling lenders to instantly classify and stack loans for buyers, which removes friction from selling unaudited or uncertified loans to investors. Read more

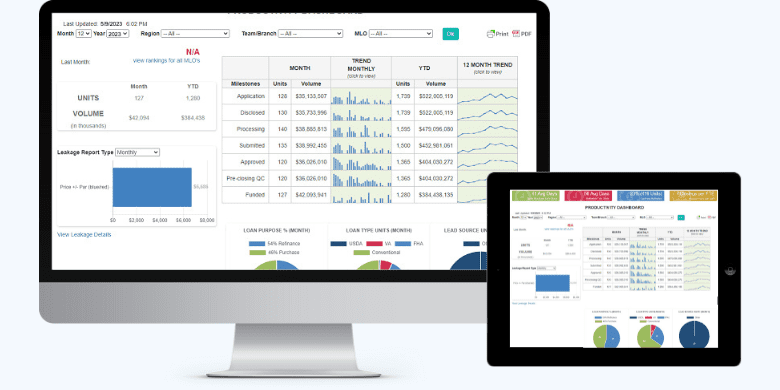

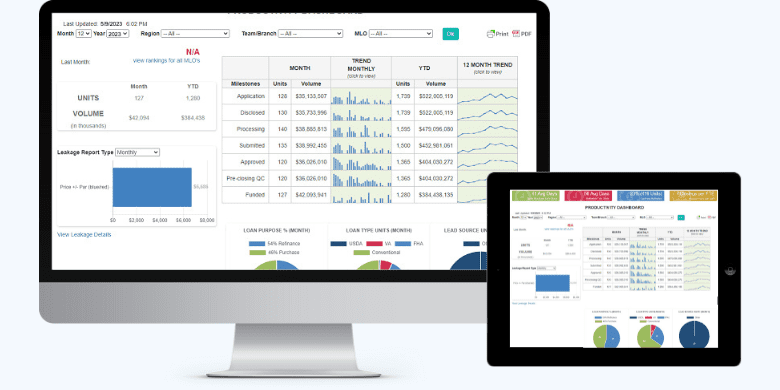

Increased Underwriter Productivity by 153%

This Top 10 national bank explored options to reduce expenses and maximize operational efficiency with its loan underwriting and servicing processes, amidst decreasing loan volumes. After implementing the Lending Intelligence Platform, the bank streamlined their document review, data verification, audit, and “decisioning” process, guaranteeing compliance with all requirements. As a result, the loan processing time was reduced by 68% while the underwriter productivity increased by 153%.

This Top 10 national bank explored options to reduce expenses and maximize operational efficiency with its loan underwriting and servicing processes, amidst decreasing loan volumes. After implementing the Lending Intelligence Platform, the bank streamlined its document review, data verification, audit, and “decisioning” process, guaranteeing compliance with all requirements. As a result, the loan processing time was reduced by 68% while the underwriter productivity increased by 153%.

What A client says about Our Work

“With the help of ELASTECH, we were able to address a massive industry challenge. The solution allows us to process, underwrite, and package/sell loans much more quickly, providing us a competitive edge and increased profitability.”

Chief Lending Officer

Top 10 National Bank

ELASTECH’s AI solutions for Lending are proven to enable firms to scale up and down without staffing headaches while achieving significant cost savings with reduced processing times.

In a discovery call, one of our experts will help confirm the benefits for you and your organization and determine potential next steps.