Lending Intelligence Platform to Increase Efficiency and Reduce Cost

Client: Top 10 National Bank

Industry: Financial Services

Reduce Expenses and Maximize Operational Efficiency

This top 10 bank explored options to reduce expenses and maximize operational efficiency with its loan underwriting and servicing processes.

With decreasing loan volume due to growing interest rates and threats of recession directly affecting Lending, the need to approve and fund loans more quickly is a priority for many organizations.

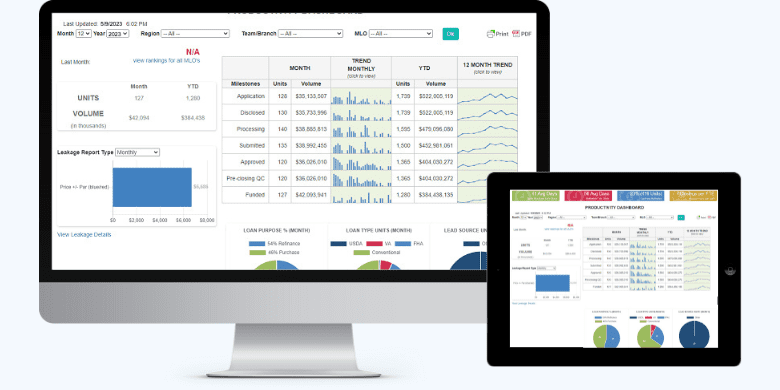

ELASTECH implemented a Lending Intelligence Platform that leverages AI modeling for document review, data verification, auditing, and “decisioning.” The platform complies with all requirements.

Highly-trained AI model with 10,000+ loan documents types that Identifies 2,000 variable data points

Solution with 99.99% audit acceptance

Application uptime of 99.995% through the adoption of Tier 4 data center security standards

What The client says about Our Work

“With the help of ELASTECH, we were able to address a massive industry challenge. The solution allows us to underwrite, process, and package/sell loans much more quickly which provides us a competitive edge through increased profitability.”

Chief Lending Officer

Top 10 National Bank

- 68% reduction in processing time

- Increased underwriter productivity by up to 153%

- Real-time validated income calculations for audit success

Interested in exploring what AI can do for your organization?

Key Technologies

Artificial

Intelligence

Lending Intelligence

Platform

Tier 4

Data Center